ESG Investing: Finding the Right Firm for You

Categorized as: About us, Education, Leadership, Social-impact investments, Stories, U.S. on August 8, 2020.

Editor’s Note: Now on to Part Three! Hopefully by now you’ve realized that ESG investing is the best thing in the investment world, and you are ready to dive in. But, maybe the firm you are using doesn’t have the ESG capabilities that you want. So, now it is time to start a search for a new firm. Read on to see more about our process and some dos and don’ts we learned along the way.

By Bri Skees, Program Officer and VP of Research and Data Management

By Bri Skees, Program Officer and VP of Research and Data Management

Where Do I Start?

The first step is deciding what type of firm you want to use. Do you want a traditional firm that has started creating some ESG portfolios? Or, do you want a firm that is probably a bit smaller but that has been working in the ESG space for decades? Maybe you would prefer to do some direct impact investments and want to use more than one firm.

After you decide what type of firm you want to use, you can do a search on different firms that have the ESG dedication you want, while also meeting any other requirements you have. It can be a pretty daunting process to begin, as there are so many firms to look at and choose from. My favorite way of navigating a lot of research is to create a spreadsheet of things I am looking for, and fill in the information as I find it. Depending on the size of your foundation, it might be easier to have a committee to help with this process.

As you research, you can begin eliminating firms based on what you find and narrow the search to 3-5 firms. Then, you can move on to the next step!

Request for Proposal (RFP)

Once you have a list of firms you are interested in, you can put together an RFP. This is when you create a list of questions you have for a potential firm, and send it to them asking for information. It also lets that firm know that you are considering them as an investment firm. It is a great way to get any and all information you could want, and gives you the opportunity to create some uniformity so that it is easier to compare apples to apples.

I have a few words of wisdom from our process that I would love to share with you. These will specifically be helpful if you are a small-staffed foundation going through this for the first time!

- Limit the length. Our RFP was about two pages of questions, which I thought seemed reasonable. However, any firm you send it to will send you as much information as possible, because they want to make sure you have all the information necessary to make the decision. The problem with this is that you get so much information, it is hard to digest and can be filled with a bunch of financial jargon. I would recommend putting a cap on the length of their submission. I wish I’d asked them to limit their responses to five pages. This would force them to include only the most vital information, and probably would have made the proposals way easier to get through.

- Limit the number of firms you send it to. In addition to the submissions being way longer than I expected (some were 50+ pages!), I also had to sift through five of them. In hindsight, it would have been better for me to dig a little deeper on my own first and reduce the number of RFPs to two or three.

- Limit the number of attachments they are allowed to submit. Some of our RFP submissions came with 10+ attachments that were referred to in their answers. This is a tricky way of them giving you even more information while not influencing the length of their submission. It can get very overwhelming.

When submitting the RFP, make sure you give the firms enough time to put the information together. We gave about a month, which seemed appropriate given the number of questions and the fact that we submitted them at the end of the year, which tends to be a busy time.

You Have Responses, Now What?

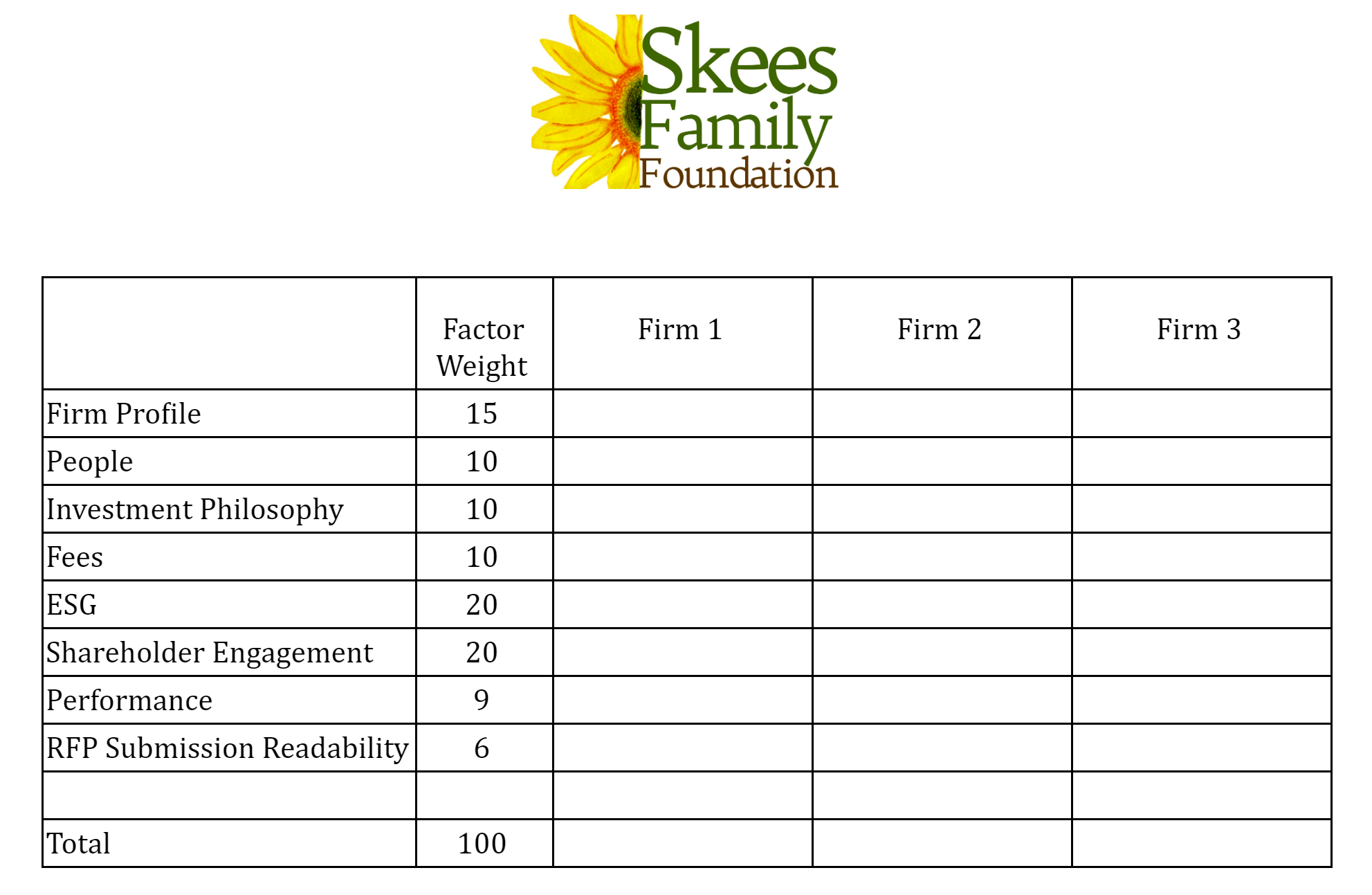

Once you get your submissions, you and your investment committee can dig in! We used rubrics that were weighted based on what was important to us in order to narrow our choices. For example, ESG integration was very important to us, so that was worth 20 points out of 100. Fees, however, are important but also very similar across the board, so that was only worth six points. Using a rubric, which probably should be agreed upon amongst your committee, helps you visualize firms’ strengths and weaknesses, and helps standardize the process to eliminate bias. It is also great for comparing various committee members’ scores.

While reading through your RFP submissions, you can eliminate the firms that don’t give you the answers you were looking for. You can meet with your investment committee and attempt to rule out any obvious misfits and narrow your scope to hopefully two or three firms. Then you’re ready for interviews!

Time to Meet Your Potential Team!

Once you have narrowed your investment firm candidates, you can conduct interviews with these firms. It’s a great opportunity to get to know the team you’d be working with and to get any clarification you might need. It can be a good idea to invite members of your board to join you. You’ll all be working together, after all. Because our board is spread out all over the world and availability was an issue, we met with our potential investment firms via video conference and were able to record the interviews for board members that were not available for the original interviews.

Making Moves

After your interviews, you can discuss them with your investment committee and perhaps even board members. Once you pick your firm, it should all be smooth sailing. Your new firm will work with your old firm to get your assets transferred and you will work closely with your new firm to figure out what you want your investment strategy to be. Then, you will officially be invested in ESG strategies!

Questions?

Run into a roadblock? I am here to help. If you have any questions or want copies of documents we used in our investment firm selection process, you can email me and we can get on a call or I can send over some documents. I have developed a huge passion for ESG investing, and am happy to help in whatever way I can.

I’ve really enjoyed studying this and moving our foundation in this direction. This is a great FIRST step in moving your assets into impactful strategies, and I hope you feel inspired to do the same!

Photos courtesy of various photographers on Unsplash.

READ Part One here, and Part Two here.

SHARE this story with your networks; see menu at top and bottom of page.

SUBSCRIBE! Like what you see? Click here to subscribe to Seeds of Hope!